Obayashi Group IR & SR Basic Policy

- 1 Basic approach to IR & SR activities

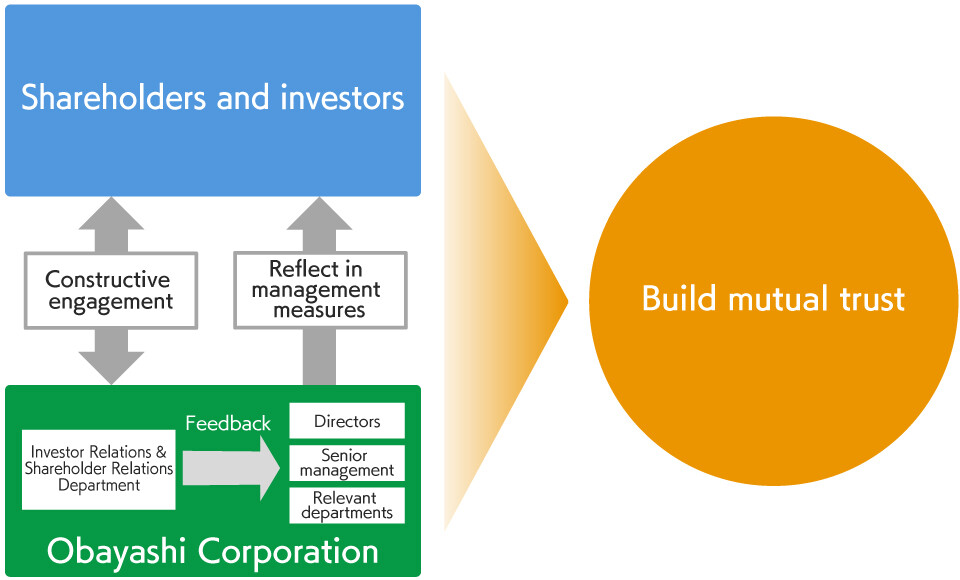

- 2 Framework regarding engagement with shareholders and investors

- 3 Initiatives to enhance means of engagement with shareholders and investors

- 4 Measures for appropriate and effective feedback of the opinions of shareholders and investors

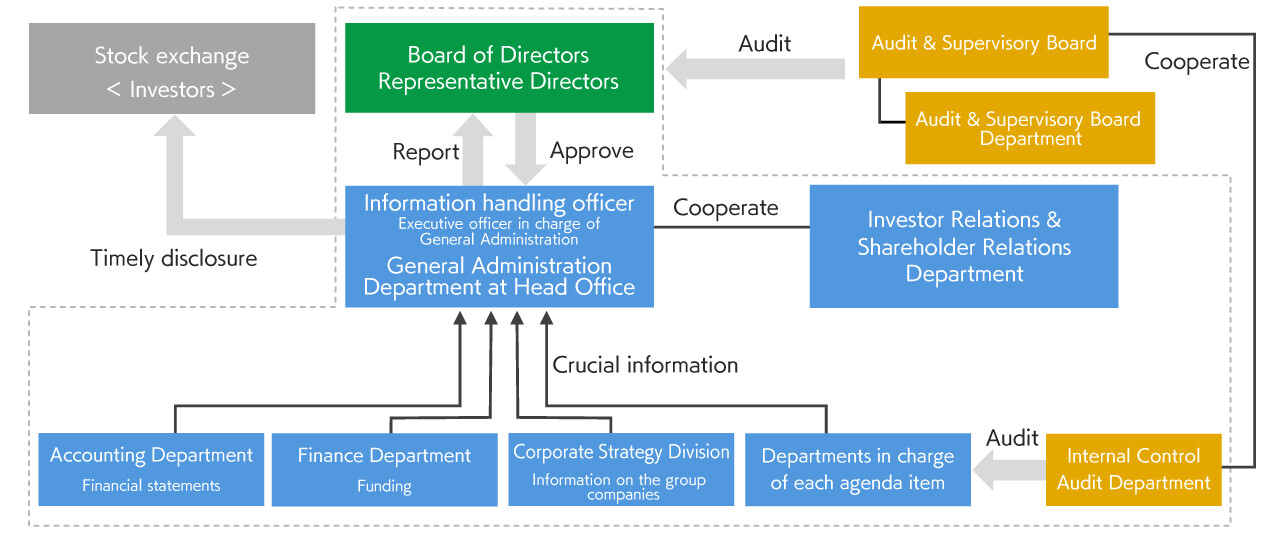

- 5 Information disclosure methods

- 6 Management of insider information

- 7 Quiet periods

- 8 Information regarding the outlook

Basic approach to IR & SR activities

In the Obayashi Basic Principles, the Obayashi Group sets forth "Ensure appropriate information disclosure and transparency of management" under the Obayashi Code of Conduct as one guideline for carrying out business activities.

We ensure management transparency by continuing constructive engagement with our shareholders, investors, and other stakeholders based on timely, appropriate, accurate, and fair information disclosure. With this, we build mutual trust with our stakeholders and achieve sustainable growth and improvement of corporate value.

Framework regarding engagement with shareholders and investors

The Obayashi Group has established the Investor Relations & Shareholder Relations Department specializing in IR and SR under the Corporate Strategy Division, which oversees management strategy. The Investor Relations & Shareholder Relations Department discloses information in a timely, appropriate, accurate, and fair manner and advances constructive engagement with shareholders and investors while coordinating with relevant departments inside the company.

Initiatives to enhance means of engagement with shareholders and investors

The Obayashi Group strives to actively provide information and thoroughly respond to questions at the Ordinary General Meetings of Shareholders, holds financial results briefings and IR and SR meetings every quarter of the fiscal year, participates in conferences organized by securities companies, holds small-group meetings, and otherwise works to enhance means of engagement, and also arranges on-site visits and business briefings for the purpose of deepening understanding of our business activities.

We also conduct timely, appropriate, accurate, and fair information disclosure to our domestic and overseas shareholders, investors, and other stakeholders via the Obayashi Corporation website or other means.

Measures for appropriate and effective feedback of the opinions of shareholders and investors

The Obayashi Group has the Investor Relations & Shareholder Relations Department periodically gather the opinions and comments from shareholders and investors through IR and SR activities, deploys these to senior management and relevant departments and works to share information. We also have the executive officer responsible for IR and SR activities present reports to the Board of Directors and to the Directors' Roundtable Meeting, as an effort to give timely, appropriate, and effective feedback. By reflecting opinions and comments received from shareholders and investors in our management measures and making engagement effective, we strive to build mutual trust with our shareholders and investors.

Information disclosure methods

Information that is subject to the Timely Disclosure Rules of the Tokyo Stock Exchange ("TSE") is disclosed via TD-NET, provided by the TSE. After disclosure, the same contents are promptly posted on the Obayashi Corporation website. We also strive to actively disclose information that is not subject to the Timely Disclosure Rules of the TSE but judged to be useful to our shareholders, investors, and other stakeholders via the Obayashi Corporation website or other means.

Information disclosure to be made

- Statutory disclosure

- Disclosure based on the Financial Instruments and Exchange Act (annual securities reports, internal control reports, extraordinary reports, etc.)

- Disclosure based on the Companies Act (business reports, financial statements, consolidated financial statements, etc.)

- Disclosure required by the TSE

Timely disclosure (decisions, occurrence of facts, earnings information)

- Corporate governance reports

- Other information disclosure

- Disclosure materials related to IR and SR, corporate reports (integrated report), engagement with shareholders and investors, etc.

Structure on timely disclosure

Management of insider information

Regarding disclosure of information that becomes the basis for engagement with shareholders and investors, in accordance with the Companies Act and other laws and regulations and stock exchange securities listing regulations, material information is broadly disclosed in a timely, appropriate, accurate and fair manner following resolutions by the Board of Directors or approval by the Representative Directors.

Regarding the management of insider information, we define company information which has a significant influence on investors' investment decisions as prescribed by the Financial Instruments and Exchange Act as material facts in our internal regulations, stipulate how these should be handled, and work to prevent insider trading by officers and employees in advance. Engagement with shareholders and investors is to be conducted by the president, the executive officer responsible for IR and SR activities, and the general manager and staff members of the Investor Relations & Shareholder Relations Department. When engagement with shareholders and investors is conducted by other officers or employees, the executive officer responsible for IR and SR activities or the general manager or staff members of the Investor Relations & Shareholder Relations Department is to be present. We strive to prevent improper leakage of information by always having multiple officers and/or employees present during engagement.

Quiet periods

To prevent leakage of earnings information and ensure fairness, the period from the day after the end of each quarter of the fiscal year until the announcement of the quarterly earnings information is set as a quiet period, and during this period we refrain from answering questions regarding financial results and the earnings outlook. However, this does not apply in cases where facts emerge that fall under timely disclosure.

Information regarding the outlook

Among the information disclosed by the Obayashi Group, future expectations such as earnings forecasts and future projections are "forward-looking statements" based on the limited information available at the present time, and these incorporate potential risk and uncertainty. For that reason, the actual results may change because of various factors. Important factors that may impact the actual results include changes in the global economic situation and the business environment.

IMPORTANT NOTICE

U.S. Disclaimer - Unsponsored ADR (American Depository Receipt)

Effective October 10, 2008, the United States Securities and Exchange Commission (SEC) made it possible for depository institutions or banks to establish ADR programs without the participation of a non-U.S. issuer (a so called "Unsponsored ADR")." An ADR, or American Depositary Receipt, is a negotiable receipt, similar to a stock certificate, which is issued by a U.S. bank or depository to evidence an ordinary share of a non-U.S. issuer that has been deposited with the U.S. bank or depository. ADRs permit a U.S. investor to purchase in a U.S. market an interest in a non-U.S. issuer's securities. An ADR program which is unsponsored is set up without the non-U.S. issuer's cooperation or even its consent. Obayashi Corporation (hereinafter the "Company") does not support or encourage the creation of unsponsored ADR facilities in respect of its securities and in any event disclaims any liability in connection with an unsponsored ADR. The Company does not represent to any depository institution, bank or anyone nor should any such entity rely on a belief that the Web site of the Company includes all published information in English, currently, and on an ongoing basis, required to claim an exemption under U.S.Exchange Act Rule 12g3-2(b).

DISCLAIMER

The information posted on Obayashi Corporation's English website was translated from Japanese into English and presented solely for the convenience of non-Japanese speaking users. The purpose of the English information provided herein is to provide the stakeholders of Obayashi Corporation with its financial and non-financial information for their better understanding of Obayashi Corporation and its group companies, and is not to solicit any person or entity to buy or sell Obayashi Corporation's securities of any kind. If there is any discrepancy between original Japanese information and its English translation, the former will prevail. Any statements made about Obayashi Corporation's future plans, forecasts, strategies and performances are forward-looking statements subject to risks and uncertainties. Forward-looking statements included herein are made based on the information available at the time of the release of the statements. Due to various factors, actual result may vary from what was anticipated in the forward-looking statements.